Maximizing revenue in healthcare organizations hinges on efficient management of accounts receivable (AR). Proper AR practices not only improve cash flow but also reduce revenue leakage and operational costs. As the healthcare industry evolves with technological advancements and changing payer requirements, adopting best practices in AR management has become more critical than ever. This guide delves into the essential aspects of AR management within revenue cycle management (RCM), emphasizing strategies to optimize reimbursement, enhance patient satisfaction, and ensure compliance.

Healthcare providers often face significant revenue loss—ranging from 5% to 15% annually—due to subpar AR processes. According to the Medical Group Management Association (MGMA), the average percentage of accounts receivable over 120 days stands at 13.54%. These statistics highlight the importance of robust AR strategies to secure financial stability and support organizational growth. Implementing industry best practices and leveraging innovative solutions, including blockchain technology, can revolutionize the way healthcare entities handle revenue collection. For a deeper understanding of how emerging technologies are reshaping healthcare finance, explore transforming healthcare through blockchain innovation.

What Is AR Management in Healthcare Revenue Cycle?

AR management in healthcare involves overseeing the entire process of tracking, collecting, and reconciling payments from insurance companies and patients. When a healthcare provider has an average AR days exceeding 25, it indicates delays in receiving payments, which can severely impact cash flow and operational efficiency. An aging AR—where payments are overdue by months—can threaten the financial health of a facility.

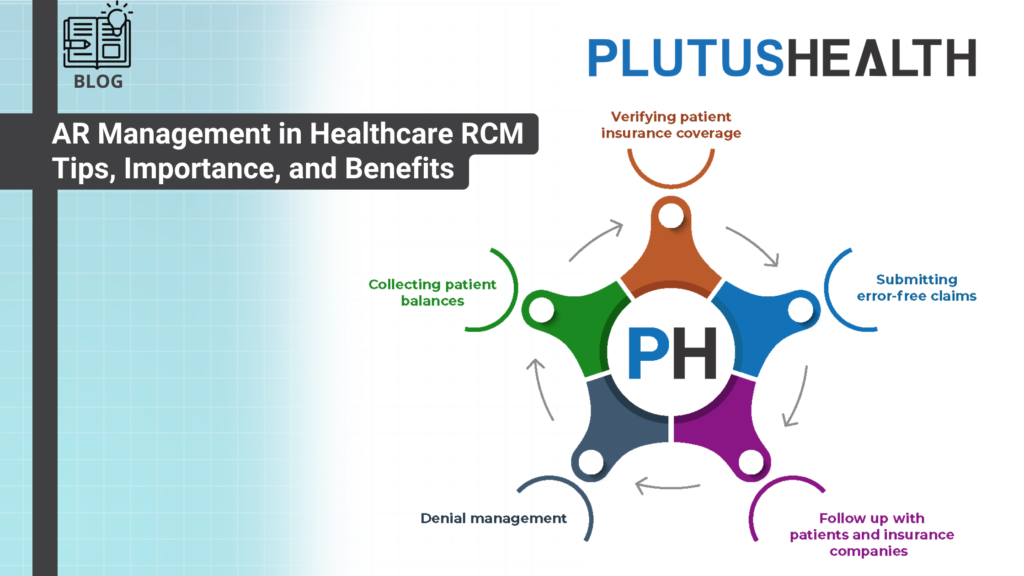

Effective AR management encompasses verifying patient insurance coverage before services are rendered, submitting accurate claims, diligently following up on unpaid accounts, managing denials, and collecting patient balances. It also includes analyzing denial trends and implementing corrective measures to minimize future rejections. As Balaji Ramani, Vice President of RCM research at Plutus Health, emphasizes, “Efficient AR management is vital for streamlining cash flow, reducing operating costs, and maximizing reimbursement.”

Verifying insurance coverage upfront ensures that providers can confidently bill for services and that patients are aware of their financial responsibilities. The American Hospital Association reports that hospitals provide approximately $41.6 billion annually in uncompensated care, underscoring the importance of precise verification and billing processes.

Submitting error-free claims is another cornerstone of effective AR management. The average cost to prepare and submit a claim ranges from $15 to $20, but errors can triple this cost due to rework and delays. Healthcare organizations that prioritize clean claim submissions often see faster reimbursements and improved cash flow. This requires skilled medical billers and coders who stay current with evolving coding standards.

Follow-up activities are crucial for maintaining a healthy revenue cycle. Regular engagement with both patients and payers helps reduce days in AR and prevents revenue stagnation. Strong relationships and prompt communication are key to resolving issues swiftly and ensuring timely payments.

Denial management is a vital component, involving the identification of root causes—often coding or documentation errors—and rapid resubmission of corrected claims. Conducting denial trend analyses allows providers to address systemic issues and prevent recurring denials, ultimately improving revenue recovery.

Collecting patient balances remains one of the most challenging yet essential tasks. A MGMA survey indicates that only about 57% of billed patient balances are recovered when billed post-service. Employing patient engagement tools like AnodynePay can facilitate faster collection through transparent communication and flexible payment options.

Periodic reporting, audits, and data analysis help AR teams identify bottlenecks and areas for improvement. Regular audits assist in risk assessment, while detailed reports on aging AR, claim denials, and follow-up activities enable proactive management and continuous process refinement.

Why Is AR Management Critical in the RCM Cycle?

AR management is central to the financial sustainability of healthcare organizations. From patient scheduling to final payment, every step in the revenue cycle relies on timely and accurate AR processes. Proper management leads to several key benefits:

- Streamlined Cash Flow: Consistent and predictable cash flow is vital for covering expenses such as staff salaries, supplies, and equipment upgrades. Effective AR strategies ensure that payments are collected efficiently, supporting ongoing operations.

- Revenue Maximization: Adequate AR processes help capture all eligible reimbursements, prevent revenue leakage, and minimize write-offs. Organizations with optimized AR often report denial rates below 5%, significantly boosting profitability.

- Enhanced Patient Satisfaction: Clear billing, prompt response to queries, and flexible payment options foster trust and loyalty among patients. As 69% of patients consider billing transparency a factor in choosing providers, quality AR management directly influences patient satisfaction.

- Regulatory Compliance: Healthcare providers must adhere to strict billing and documentation standards. Proper AR practices ensure clean claim submissions, reducing penalties and audit risks. Staying compliant is essential for avoiding legal complications and reputational damage.

The Three Stages of AR Management

Understanding and implementing each stage of AR management can significantly improve revenue outcomes.

Interesting:

- Understanding and improving days in accounts receivable a r in healthcare revenue management

- Enhancing revenue through comprehensive payer mix analysis in healthcare

- A comprehensive guide to healthcare revenue cycle management phases steps and best practices

- Mastering the 13 essential steps of healthcare revenue cycle management

Stage 1: Pre-invoice Preparation

This initial phase involves setting up accurate payer and patient accounts, verifying insurance coverage, and establishing clear payment terms. Key activities include:

- Conducting credit checks: Verifying patients’ financial stability and history to assess risk.

- Establishing payment agreements: Clearly defining payment expectations based on insurance coverage and patient capacity.

- Creating patient profiles: Collecting contact details, billing preferences, and insurance information to facilitate smooth billing.

Stage 2: Invoicing

The second stage centers on generating and delivering accurate invoices promptly. Essential tasks involve:

- Producing precise claims: Ensuring that medical codes, descriptions, and patient details are correct to avoid delays.

- Timely delivery: Utilizing electronic billing systems for faster processing.

- Follow-up on unpaid invoices: Initiating contact via calls or emails if payments are overdue, which helps reduce AR days.

Stage 3: Payment Collection and Reconciliation

The final phase involves receiving payments, reconciling accounts, and addressing denials efficiently:

- Recording payments: Ensuring all payments are accurately entered into financial systems.

- Reconciling accounts: Comparing received payments against billed amounts to identify discrepancies.

- Handling denials: Investigating and resolving claim denials swiftly, which may include appealing or correcting documentation.

Tips for Achieving Efficient AR Management

Optimizing AR processes demands strategic planning and ongoing oversight. Key recommendations include:

- Verifying patient insurance eligibility before services: This reduces claim rejections and claim denials. For insights on how to leverage emerging technologies in healthcare finance, see advancing healthcare with blockchain an empirical model of adoption drivers and barriers.

- Ensuring accurate coding: Certified coders familiar with current standards prevent billing errors that lead to delays.

- Submitting claims promptly: Implementing automated tracking systems helps meet deadlines and speeds up reimbursement.

- Regularly following up on unpaid claims: Establish routines for timely intervention to minimize AR days.

- Monitoring denials and appeals: Data analysis helps identify recurring issues, enabling targeted improvements.

- Offering flexible payment plans: Facilitating payment options can improve collection rates and patient satisfaction.

- Training staff consistently: Continuous education on regulations, coding updates, and best practices enhances overall AR performance.

When Should Healthcare Organizations Consider Outsourcing AR Management?

Outsourcing AR functions can be advantageous, especially for organizations seeking to focus on core clinical activities or lacking in-house expertise. Common processes suitable for outsourcing include:

- Claim processing: To reduce errors and accelerate reimbursements.

- Denial management: To improve appeal success rates.

- Payment posting: To minimize manual errors and speed up reconciliation.

- Follow-up and collections: To decrease bad debt and free internal staff for strategic initiatives.

Choosing a reputable outsourcing partner involves evaluating their experience, technological capabilities, and compatibility with organizational goals. Outsourcing not only enhances efficiency but also allows healthcare providers to focus on delivering quality care.

Benefits of Outsourcing AR Management

Healthcare providers often find that strategic outsourcing results in:

- Faster and more accurate claims processing

- Reduced AR days

- Increased collection rates

- Improved cash flow

- Enhanced focus on patient care

For organizations exploring such options, partnering with experienced firms like Plutus Health can lead to measurable financial improvements.

Final Thoughts

Effective AR management is the backbone of a healthy revenue cycle. By understanding its stages, adopting best practices, and leveraging technological advancements—including blockchain solutions—healthcare organizations can substantially increase reimbursement rates, reduce denials, and elevate patient satisfaction. Continuous evaluation and strategic outsourcing, when appropriate, can further optimize revenue cycle performance. To stay ahead in an increasingly competitive environment, healthcare providers must prioritize AR excellence in their operational strategies.

—

For further insights into innovative healthcare finance solutions, consider exploring transforming healthcare through blockchain innovation, which offers a comprehensive view of how emerging technologies are reshaping revenue management.