Managing health insurance plans can often feel overwhelming, especially when trying to cancel a policy or subscription. Whether you’re switching providers, no longer need coverage, or simply want to streamline your finances, knowing the correct procedures is essential. This guide walks you through the step-by-step process of canceling your United Healthcare plan, ensuring you do it correctly and efficiently. Additionally, it highlights how tools like Emma can help you keep track of your finances and recurring payments, providing clarity on your subscriptions and expenses.

—

How to Cancel Your United Healthcare Insurance

Canceling your United Healthcare insurance involves several straightforward steps. First, you need to contact their customer service to initiate the cancellation process. Dial their official customer service number, which is (800) 926-7602. When connected, request to speak directly with a live representative who can assist you with your cancellation. Be prepared to provide your policy number alongside personal identification details to verify your account.

Once you’ve reached the representative, clearly state your intent to cancel the policy and any recurring payments associated with it. It’s advisable to request a confirmation email or written proof of the cancellation for your records. This confirmation serves as proof in case any disputes or billing issues arise later.

For those who prefer calling over the phone, ensure to call during business hours to speak with a live agent directly. Remember, cancellation procedures may vary slightly depending on your specific plan or location, so it’s always a good idea to double-check any additional requirements on the official United Healthcare website at uhc.com.

If you wish to cancel your policy through other means, such as online or via mail, contact their customer support for guidance. Some policies may require you to submit a written request or complete an online form, which can be found on their official portal.

—

Additional Tips for Cancelling and Managing Subscriptions

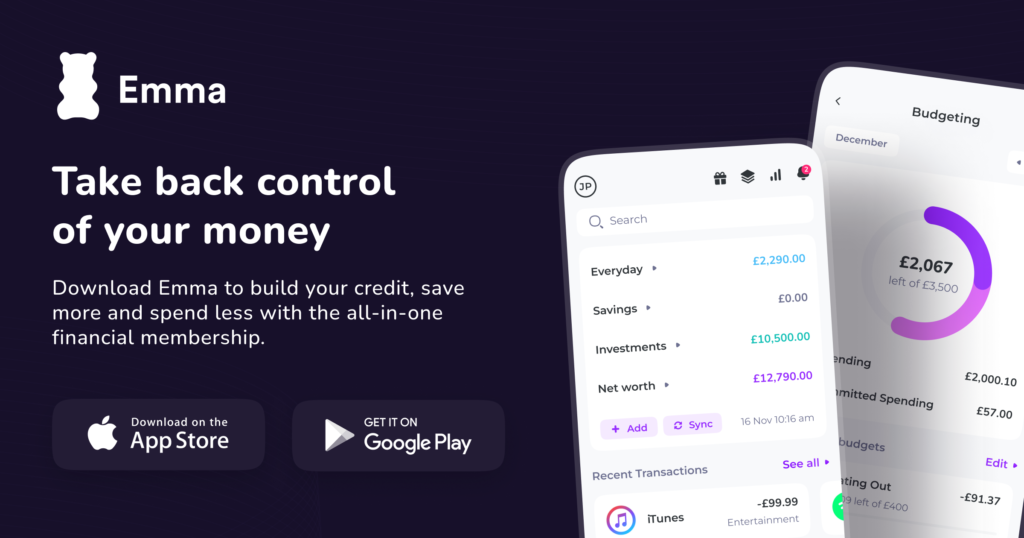

Canceling a health insurance plan is often just part of managing your overall subscriptions. Using financial management apps like Emma can help you see all your recurring payments in one centralized location. This way, you can identify and cancel unwanted subscriptions easily, including insurance plans like United Healthcare, if necessary.

Emma connects to your bank accounts to provide a comprehensive view of your financial commitments. You can view your payment history, set budgets, and even receive alerts about upcoming charges. This makes it easier to ensure you’re not paying for services you no longer need or have canceled. For a detailed guide on how to perform actions like deleting or unsubscribing from accounts, Emma offers step-by-step assistance. Check out how Emma enables assisting doctors in healthcare to see how digital tools improve financial and healthcare management.

Furthermore, understanding the future scope of AI in healthcare can help you stay informed about evolving services and tools that might impact your insurance needs. Explore innovations by reading about the transformative potential of AI for healthcare.

Interesting:

—

Recognizing Your Payments on Statements

When canceling your United Healthcare plan, it’s useful to recognize how the charges might appear on your bank or credit card statements. Common descriptions include:

- UNITEDHEALTHCARE – HCE

- UNITEDHEALTHCARE UHCHCE0831

- UNITEDHEALTHCARE PREMIUM

- UNITEDHEALTHCARE 800-657-8205 IN

Being familiar with these labels helps you identify the payments related to your insurance policy and ensure that your cancellation has been processed correctly. If you see any discrepancies or recurring charges after canceling, contact United Healthcare directly or review your bank statements through tools like Emma.

—

How to Use Financial Apps to Track and Cancel Subscriptions

Once you’ve canceled your United Healthcare plan, maintaining a clear overview of your finances is crucial. Downloading Emma allows you to see all your money, subscriptions, and recurring payments in one place. This helps prevent unwanted charges and simplifies the process of managing your finances.

To get started, simply connect your bank accounts within the app. Afterward, click on the “see all” section to review your payments, including health insurance premiums. You can also view and edit payment details, helping you stay on top of your financial commitments. Emma’s features extend to building credit, saving more, and spending wisely—making it a comprehensive tool for financial health.

For more details on how digital tools are transforming healthcare and financial management, check out how Servreality bridges the gap with XR in medicine, showcasing innovative technological integrations.

—

Final Notes

Canceling United Healthcare isn’t complicated if you follow the proper procedure. Always verify the process with official sources and keep documentation of your cancellation confirmation. Additionally, leveraging financial management apps like Emma can help you stay organized, monitor your subscriptions, and ensure you’re not paying for services you no longer need.

Whether you’re canceling health insurance or other subscriptions, staying informed about your payments and the latest technological advances in healthcare can save you time and money. Stay proactive in managing your health coverage and finances to maintain control over your financial health and well-being.